TABLE OF CONTENTS

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment

Filed by the Registrant ☒

Filed by a Party other than the Registrant

☐

Check the appropriate box:

| ☐

| Preliminary Proxy Statement |

☐

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒

| Definitive Proxy Statement |

| ☐

| Definitive Additional Materials |

| ☐

| Soliciting Material under §240.14a-12 |

HUB GROUP, INC.

(Name of Registrant as Specified In Its Charter)

HUB GROUP, INC.

|

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | ☐ | | Fee paid previously with preliminary materials. |

☐ | | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

TABLE OF CONTENTS

March 22, 2017

Hub Group, Inc.

2001 Hub Group Way

OAK BROOK, ILLINOIS 60523

April 14, 2023

Dear

Fellow Stockholder:

You are cordially invited to attend

We will hold the

20172023 Annual Meeting of Stockholders

(the “Annual Meeting”) of Hub Group, Inc.

This meeting will be held at Hub Group’s Corporate Headquarters, located at 2000 Clearwater Drive, Oak Brook, Illinois at 10:00 a.m. Central

timeTime on

Wednesday,Thursday, May

10, 2017.25, 2023. Our Annual Meeting will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting physically.

As in prior years, we have again elected to provide access to our proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rules. The

accompanying Notice of

20172023 Annual Meeting of Stockholders and Proxy Statement describes the matters to be acted upon and is available at

www.proxyvote.com and at our corporate website www.hubgroup.com/proxy.html. Theproxy. Our Annual Report

to Stockholders on Form 10-K

for the fiscal year ended December 31, 2022 also is

also available at

this website.those websites. We hopebelieve that providing our proxy materials over the Internet increases the ability of our stockholders to obtain the information they need, while reducing the environmental impact of the Annual Meeting and our costs associated with the physical printing and mailing of proxy materials.

It is important that your shares be represented at the Annual Meeting. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/HUBG2023, you will be able to attendmust enter the meeting. However,control number found on your proxy card, voting instruction form or notice you previously received. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting, although, even if you anticipate attending in person,the virtual meeting, we urge you to please vote your proxy either by mail, telephone or over the Internet in advance of the Annual Meeting to ensure that your shares will be represented. If you attend,We hope you will of course, be entitledparticipate in the Annual Meeting.

I look forward to

voteupdating you on developments in

person.our business at the Annual Meeting. | | | Sincerely, |

| | | |

|  |

| | |

| | DAVID P.PHILLIP D. YEAGER |

| Chairman

President and Chief Executive Officer |

YOUR VOTE IS IMPORTANT

PLEASE VOTE EITHER BY

MAIL, TELEPHONE OR OVER THE INTERNET

WHETHER OR NOT YOU EXPECT TO PARTICIPATE IN THE ANNUAL MEETING.

TABLE OF CONTENTS

HUB GROUP, INC.

Hub Group, Inc.

2001 Hub Group Way

OAK BROOK, ILLINOIS 60523

NOTICE OF

20172023 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Hub Group, Inc.:

The

2023 Annual Meeting of Stockholders

(the “Annual Meeting”) of Hub Group, Inc., a Delaware corporation, will be held

at Hub Group’s Corporate Headquarters, located at 2000 Clearwater Drive, Oak Brook, Illinoisexclusively online via the Internet on

Wednesday,Thursday, May

10, 2017,25, 2023, at 10:00 a.m. Central time for the following purposes:

| (1)

| To elect the eightten nominees listed in thisthe accompanying proxy statement to the Company’s board of directors of the Company;directors; |

| (2)

| To holdapprove, on an advisory vote on executive compensation;basis, the compensation paid to the Company’s Named Executive Officers; |

| (3)

| To hold an advisory vote on the frequency of the advisory vote on executive compensation; |

| (4)

| To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm;accountants for the fiscal year ended December 31, 2023; |

| (5)

| To approve an amendment to our amended and restated certificate of incorporation to limit the Hub Group, Inc. 2017 Long-Term Incentive Plan;liability of certain officers of the Company as permitted by recent amendments to Delaware law; and |

| (6)

| To transact such other business as may properly be presented at the Annual Meeting or any adjournment thereof. |

We plan to send a Notice of Internet Availability of Proxy Materials

(the “Notice”) to our stockholders instead of paper copies of our proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022. The Notice, which is expected to be mailed to stockholders on or about

March 22, 2017. The Notice of Internet Availability of Proxy MaterialsApril 14, 2023, contains instructions on how to access our materials on the Internet, as well as instructions on obtaining a paper copy of the proxy materials. The Notice

of Internet Availability of Proxy Material is not a form for voting and presents only an overview of the proxy materials.

The Annual Meeting will be presented exclusively online at www.virtualshareholdermeeting.com/HUBG2023. You will be able to attend the Annual Meeting online, vote your shares electronically and submit your questions to management during the Annual Meeting by visiting www.virtualshareholdermeeting.com/HUBG2023.

Your vote is important and we encourage you to vote in advance of the Annual Meeting. Whether or not you plan to attend the virtual Annual Meeting, please vote by telephone or over the Internet, or by completing, signing, dating and returning your proxy card or voting instruction form so that your shares will be represented at the Annual Meeting. Instructions for voting are described in the Notice, the Proxy Statement and the proxy card.

The Board of Directors has fixed the close of business on March

13, 2017,29, 2023, as the record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting.

| | | By order of the Board of Directors, |

| | | |

|  | | THOMAS P. LAFRANCE |

| | | Secretary |

Oak Brook, Illinois | DOUGLAS G. BECK | | |

April 14, 2023 | Secretary | | |

Oak Brook, Illinois

March 22, 2017

YOUR VOTE IS IMPORTANT

PLEASE VOTE YOUR PROXY EITHER BY

MAIL, TELEPHONE OR OVER THE INTERNET

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING.

Important Notice of Internet Availability of Proxy

Materials for the Stockholders Meeting to be Held on May 10, 2017

The Proxy Statement and Annual Report to Stockholders are

Available atwww.hubgroup.com/proxy.html

TABLE OF CONTENTS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 25, 2023

This Notice of 2023 Annual Meeting of Stockholders, our Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2022 and a form of proxy card or voting instruction form (collectively, the “Proxy Materials”) are available at www.proxyvote.com. You will need your Notice of Internet Availability (“Notice”) or proxy card to access the Proxy Materials there. A copy of our Proxy Materials also can be found on our corporate website – www.hubgroup.com/proxy.

As permitted by rules adopted by the Securities and Exchange Commission (“SEC”), we are furnishing our Proxy Materials over the Internet to some of our stockholders. This means that some stockholders will not receive paper copies of these documents but instead will receive only a Notice containing instructions on how to access the Proxy Materials over the Internet and how to request a paper copy of our Proxy Materials. Stockholders who do not receive a Notice will receive a paper copy of the Proxy Materials by mail, unless they have previously requested delivery of Proxy Materials electronically.

TABLE OF CONTENTS

iii

[This page intentionally left blank]

2001 Hub Group Way

HUB GROUP, INC.

2000 CLEARWATER DRIVE

OAK BROOK, ILLINOIS 60523

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Hub Group, Inc., a Delaware corporation (“Hub Group” or the “Company”), of proxies for use at the 2017

Annual Meeting of Stockholders of the Company to be held on Wednesday, May 10, 2017,25, 2023

SOLICITATION, MEETING AND VOTING INFORMATION

A:

| This document is the Proxy Statement of Hub Group, Inc. that is being made available to stockholders on the Internet, or sent to stockholders by mail or electronically by e-mail upon request, in connection with our Annual Meeting of stockholders to be held on Thursday, May 25, 2023 exclusively online via the Internet (the “Annual Meeting”). A proxy card is also being furnished with this document, if you requested printed copies of the Proxy Materials. We have tried to make this document simple and easy to understand. The SEC encourages companies to use “plain English,” and we always try to communicate with you clearly and effectively. We refer to Hub Group, Inc. throughout as “we,” “us,” the “Company” or “Hub Group.” Additionally, unless otherwise noted or required by context, “2023,” “2022,” and “2021,” refer to our fiscal years ended or ending December 31, 2023, 2022, and 2021, respectively. |

Q:

| What documents constitute our “proxy materials”? |

A:

| The Proxy Materials include the Notice of 2023 Annual Meeting of Stockholders, the Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2022 and the proxy card or voting instruction form. |

Q:

| What is a proxy, who is asking for it, and who is paying for the cost to solicit it? |

A:

| A proxy is your legal designation of another person, called a “proxy,” to vote your stock. The document that designates someone as your proxy is also called a proxy or a proxy card. |

Our directors, officers, and employees are soliciting your proxy on behalf of our Board of Directors. Those persons will not receive additional payment or compensation for doing so except reimbursement for any adjournment thereof (the “Annual Meeting”). This Proxy Statementrelated out-of-pocket expenses. We will, upon request, reimburse brokers, banks, custodians and accompanying formsimilar organizations for their expenses in forwarding proxy materials to beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, personal contact, email and other electronic means, advertisements and personal solicitation, or otherwise. The Company will pay the expense of any proxy are first being sentsolicitation. We may hire a proxy solicitation firm at standard industry rates to assist in the solicitation of proxies.

Q:

| Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? |

A:

| Pursuant to SEC rules, the Company is using the Internet as the primary means of furnishing proxy materials to stockholders again this year. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to the Company’s stockholders. If you received a Notice by mail, you will not receive a printed copy of the proxy materials unless you request one. Instead, the Notice will instruct you as to how you may access and review the proxy materials online. Instructions on how to request a printed copy of the proxy materials also may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing |

TABLE OF CONTENTS

basis. The Company encourages stockholders

on or about March 22, 2017.The Company’s Class A common stock, $.01 par value (the “Class A Common Stock”), and Class B common stock, $.01 par value (the “Class B Common Stock,” together with the Class A Common Stock, the “Common Stock”), are the only issued and outstanding classes of stock. Only stockholders of record at the close of business on March 13, 2017 (the “Record Date”), are entitled to notice of and to vote at the Annual Meeting. Astake advantage of the Record Date,availability of the Company had 33,480,802 sharesproxy materials on the Internet to help reduce the environmental impact of Class A Common Stock (each a “Class A Share”)its Annual Meetings and 662,296 shares of Class B Common Stock (each a “Class B Share,” and collectively with the Class A Shares, the “Shares”) outstanding and entitled to vote.

PROXIES, VOTING RIGHTS,QUORUM AND PROCEDURES

Shares represented by an effective proxy given by a stockholder will be voted as directed by the stockholder. If a properly signed proxy form is returnedcost to the Company and one or more proposals are not marked, it will be voted in accordanceassociated with the recommendationphysical printing and mailing of the Board of Directors on all such proposals. A stockholder giving a proxy may revoke it at any time prior to the voting of the proxy by giving written notice to the Secretary of the Company, by executing a later dated proxy or by attending the Annual Meeting and voting in person. If your shares are held in a bank or brokerage account, you will receive proxy materials from your bank or broker, which will include a voting instruction form. If you would like to attend the Annual Meeting and vote these shares in person, you must obtain a proxy from your bank or broker. You must request this form from your bank or broker; they will not automatically supply one to you.

Each Class A Share is entitled to one (1) vote and each Class B Share is entitled to approximately eighty-four (84) votes. The Amended and Restated Bylaws of the Company (the “Bylaws”) provide that one third of Sharesmaterials.

Q:

| Why am I receiving these materials? |

A:

| You received the Notice and you are receiving this document because you were one of our stockholders on March 29, 2023, the record date for the Annual Meeting. We are soliciting your proxy (i.e., your permission) to vote your shares of Hub Group stock upon certain matters at the Annual Meeting. |

Q:

| What if I have more than one account? |

A:

| Please vote proxies for all accounts to ensure that all your shares are voted. You may consolidate multiple accounts through our transfer agent, American Stock Transfer & Trust Company, LLC (“AST”), online at www.astfinancial.com or by calling (800) 937-5449. |

Q:

| Who may access the virtual Annual Meeting? |

A:

| Only stockholders and their proxy holders will be able to access the virtual Annual Meeting. As indicated, we will not have an in-person Annual Meeting. You will need to enter the 16-digit control number received with your proxy card or the Notice to enter the Annual Meeting via the online web portal. See “If I vote by proxy, can I still access the Annual Meeting and vote there if I choose?” below. |

Q:

| How many votes must be present to hold the Annual Meeting? Do abstentions and “broker non-votes” count? |

A:

| Our Amended and Restated Bylaws (the “Bylaws”) provide that the presence of the holders of one-third of the shares of capital stock entitled to vote at a meeting, present in person or represented by proxy, will constitute a quorum at the Annual Meeting. Stockholders who participate in the virtual Annual Meeting will be deemed to be present in person. A quorum must exist to conduct any business at the Annual Meeting. If a quorum is not present at the Annual Meeting, the holders of the stock present in person or represented by proxy at the meeting and entitled to vote thereat have power, by a majority of the votes cast by shares represented in person or by proxy, to adjourn the meeting to another time and/or place, without notice other than announcement at the meeting, until a quorum is be present or represented. |

Abstentions will be treated as Sharesshares that are present and entitled to vote for purposes of determining the presence of a quorum. If you are a beneficial stockholder and your shares are held in the name of a broker, the broker has the authority to vote shares for which you do not provide voting instructions only with respect to certain “routine” matters. A broker non-vote occurs when a nominee who holds shares for another does not vote on a particular matter because the matter is not a “routine” matter for which the broker has discretionary voting authority and the broker has not received instructions from the beneficial owner of the shares. The proposal to ratify the selection of Ernst & Young LLP as the Company’s independent registered accounting firm is deemed a “routine” matter. All other proposals described in this proxy statement do not relate to “routine” matters. As a result, a broker will not be able to vote your shares with respect to these proposals absent your voting instructions. Additionally, broker non-votes are included in the calculation of the number of votes considered to be present at the Annual Meeting for purposes of determining the presence of a quorum only when there are “routine” matters to be voted upon. Because there is a “routine” matter to be voted upon at the Annual Meeting, broker non-votes also will be included for purposes of determining a quorum. An inspectorSee “What are ‘broker votes’ and ‘broker non-votes’?” below.

Q:

| Who may vote at the Annual Meeting? |

A:

| Only stockholders of record at the close of business on March 29, 2023 (the “Record Date”), are entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 32,799,567 shares of Class A Common Stock (each a “Class A Share”) and 574,903 shares of Class B Common Stock (each a “Class B Share,” and collectively with the Class A Shares, the “Shares”) outstanding and entitled to be voted at the Annual Meeting. Each Class A Share is entitled to one (1) vote and each Class B Share is entitled to approximately eighty-four (84) votes. |

Q:

| Will a list of stockholders entitled to vote at the Annual Meeting be available? |

A:

| In accordance with Delaware law, a list of stockholders entitled to vote at the Annual Meeting will be available for any purpose germane to the Annual Meeting beginning May 15, 2023 at our corporate headquarters during regular business hours. |

TABLE OF CONTENTS

Q:

| What am I voting on at the Annual Meeting? |

A:

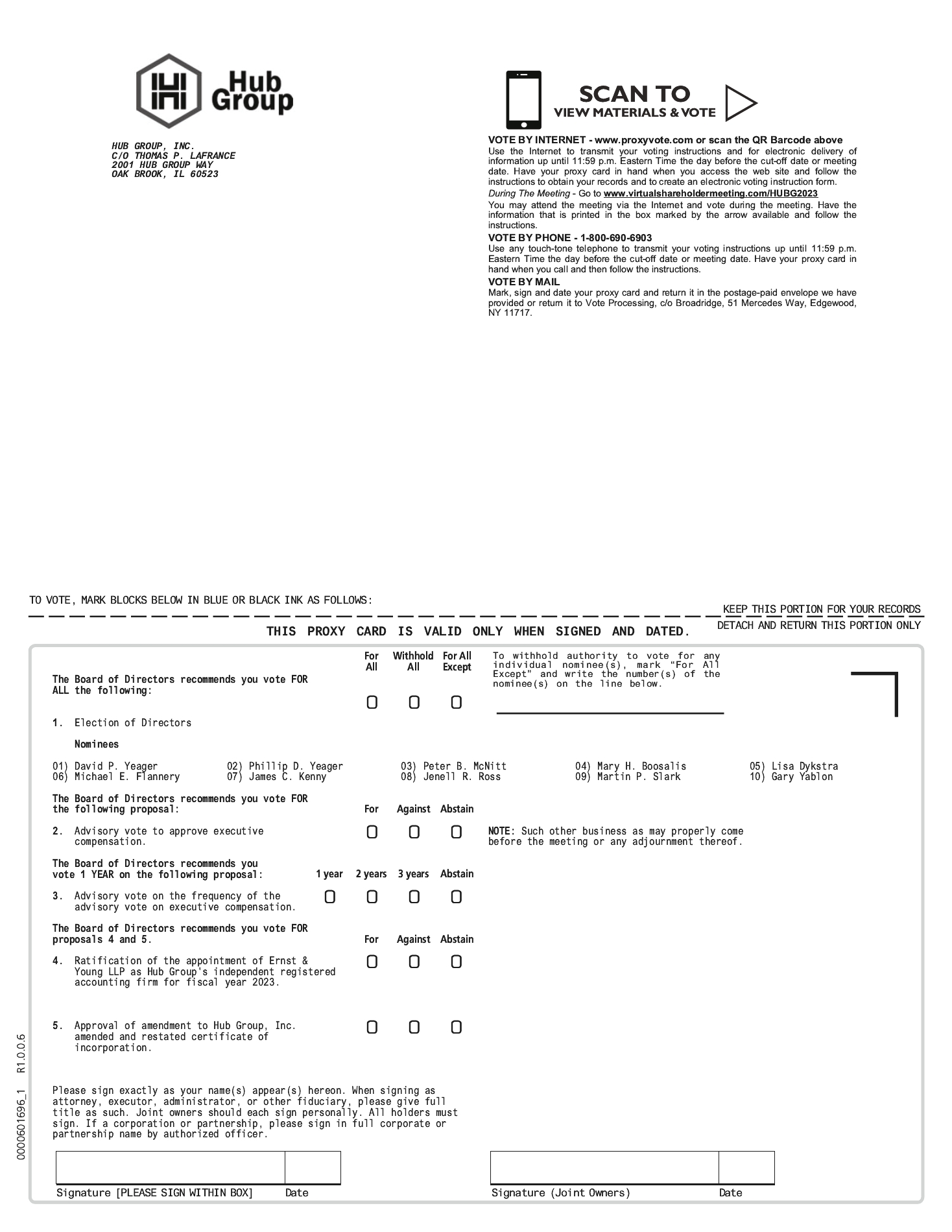

| There are five proposals to be considered and voted on at the Annual Meeting: |

To elect the ten director nominees identified in this Proxy Statement to our Board of elections appointedDirectors, each to serve a one-year term expiring at the earlier of the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) or upon his or her successor being elected and qualified;

To approve, on an advisory (non-binding) basis, the compensation paid to our Named Executive Officers (“say-on-pay” vote);

To approve, on an advisory (non-binding) basis, the frequency of the “say-on-pay” votes (“say-on-frequency” vote);

To ratify the appointment of Ernst & Young LLP (“E&Y”) as our independent registered public accountants for 2023; and

To approve the meetingamendment to Hub Group, Inc.’s Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the Company as permitted by recent amendments to Delaware law (the “Charter Amendment”).

We will tabulatealso consider other business that properly comes before the Annual Meeting in accordance with Delaware law and our Bylaws.

Q:

| What are my choices when voting on the election of the ten director nominees identified in this Proxy Statement, and what vote is needed to elect nominees to the Board of Directors? |

A:

| Regarding the vote on the election of the ten director nominees identified in this Proxy Statement to serve until the 2024 Annual Meeting or until his or her successor is elected and qualified, stockholders may: |

| • | vote “FOR” all of the director nominees; |

| • | vote in “FOR ALL EXCEPT” specific director nominees; or |

| • | vote to “WITHHOLD ALL” authority to vote for all director nominees. |

Directors are elected by a plurality of the votes cast by proxy orthe shares represented in person or by proxy and entitled to vote at the Annual Meeting on the election of directors provided a quorum is present. Withholding of authority to vote in the election and broker non-votes will not affect the outcome of the election, provided a quorum is present. As a result, the ten nominees receiving the highest number of “FOR” votes will be elected as directors.

Q:

| What are my choices when voting on the advisory (non-binding) proposal regarding the compensation paid to the Company’s Named Executive Officers (“say-on-pay”), and what vote is needed to approve the advisory say-on-pay proposal? |

A:

| Regarding the advisory (non-binding) proposal on the compensation paid to our Named Executive Officers, stockholders may: |

| • | vote “FOR” the advisory say-on-pay proposal; |

| • | vote “AGAINST” the advisory say-on-pay proposal; or |

| • | “ABSTAIN” from voting on the advisory say-on-pay proposal. |

The affirmative vote of a majority of votes cast by the shares represented in person or by proxy and entitled to vote at the Annual Meeting is required to approve, on an advisory basis, the say-on-pay vote. As an advisory vote, this proposal is not binding upon us. However, our Compensation Committee, which is responsible for designing and administering our executive compensation program, values the opinions expressed by our stockholders and will consider the outcome of the vote when making future compensation decisions. For additional information, please see the discussion on page 47 of this Proxy Statement. TABLE OF CONTENTS

Q:

| What are my choices when voting on the advisory (non-binding) proposal on the frequency of “say-on-pay” votes (“say-on-frequency”), and what vote is needed to approve the advisory say-on-frequency proposal? |

A:

| Regarding the advisory (non-binding) proposal on frequency of our advisory votes regarding the compensation paid to our Named Executive Officers, stockholders may indicate their preference to vote on Named Executive Officer compensation with a frequency of: |

| • | “ABSTAIN” from voting on the advisory say-on-frequency proposal. |

The affirmative vote of a majority of the votes cast by the shares represented in person or by proxy and entitled to vote at the Annual Meeting is required to approve, on an advisory basis, the say-on-frequency vote. As an advisory vote, this proposal is not binding upon us. However, our Compensation Committee, which is responsible for designing and administering our executive compensation program, values the opinions expressed by our stockholders and will consider the outcome of the vote when making future compensation decisions. For additional information, please see the discussion on page 48 of this Proxy Statement. Q:

| What are my choices when voting on the ratification of the appointment of E&Y as the Company’s independent registered public accountants for the fiscal year ending December 31, 2023, and what vote is needed to ratify their appointment? |

A:

| Regarding the vote on the proposal to ratify the appointment of E&Y as the Company’s independent registered public accountants for 2023, stockholders may: |

| • | vote “FOR” the ratification; |

| • | vote “AGAINST” the ratification; or |

| • | “ABSTAIN” from voting on the ratification. |

The affirmative vote of a majority of the shares represented at the Annual Meeting and

such inspectorentitled to vote is required to approve the proposal to ratify the appointment of

elections will determine whether or notE&Y as our independent registered public accountants for 2023. For additional information, please see the discussion on page 50 of this Proxy Statement. Q:

| What are my choices when voting on the approval of the Charter Amendment? |

A:

| Regarding the approval of the Charter Amendment, stockholders may: |

| • | vote “FOR” approving the Charter Amendment; |

| • | vote “AGAINST” approving the Charter Amendment; or |

| • | “ABSTAIN” from voting on the Charter Amendment. |

The affirmative vote of a

quorum is present.

As of March 13, 2017, members of the Yeager family, directly or by trust, own all 662,296 shares of Class B Common Stock (the “Class B Stockholders”). Consequently, the Class B Stockholders control approximately 62%majority of the voting power on all matters presented for stockholder action. Theof our Class A common stock and Class B Stockholders are parties to an Amendedcommon stock outstanding and Restated Stockholders’ Agreement, dated April 22, 2014 (the “Stockholders’ Agreement”), pursuant to which they have agreedentitled to vote all of their shares of Class B Common Stock in accordance with the vote of the holders of a majority of such Class B Shares. The Stockholders’ Agreement requires, among other things, that the Class B Stockholders hold a meeting prior toat the Annual Meeting, so that they can determinevoting together as a single class, is required to approve the Charter Amendment. For additional information, please see the discussion on page 52 of this Proxy Statement.

Q:

| How does the Company’s Board of Directors recommend that I vote? |

A:

| Please see the information included in this Proxy Statement relating to the proposals to be considered and voted on at the Annual Meeting. Our Board of Directors unanimously recommends that you vote: |

| • | “FOR ALL” of the ten nominees to our Board of Directors identified in this Proxy Statement; |

| • | “FOR” the advisory (non-binding) proposal regarding the compensation paid to our Named Executive Officers (“say-on-pay”); |

TABLE OF CONTENTS

| • | For a frequency of “ONE YEAR” for the advisory (non-binding) proposal regarding the frequency of advisory votes regarding the compensation paid to our Named Executive Officers (“say-on-frequency”); |

| • | “FOR” the ratification of the appointment of E&Y as our independent registered public accountants for 2023; and |

| • | “FOR” the approval of the Charter Amendment. |

Q:

| How will the Class B Shares be voted at the Annual Meeting? |

A:

| As of March 29, 2023 members of the Yeager family, directly or by trust, own all 574,903 outstanding Class B Shares (the “Class B Stockholders”). The Class B Stockholders control approximately 59.6% of the voting power on all matters presented for stockholder action. Certain Class B Stockholders (the “Class B Agreement Parties”), representing 351,748 or 61.2% of the Class B Shares and approximately 36.4% of the voting power on all matters presented for stockholder action, are parties to the DPY Stockholders’ Agreement dated February 22, 2023 (the “DPY Stockholders’ Agreement”). The Class B Agreement Parties have agreed in the DPY Stockholders’ Agreement to vote all of their Class B Shares (the “Class B Agreement Shares”) in accordance with the vote of the holders of a majority of the Class B Agreement Shares. Mr. David P. Yeager owns or controls as trustee of certain trusts 311,692 Class B Shares representing a majority of the Class B Agreement Shares. As a result, Mr. David P. Yeager will have the power to direct the vote of all Class B Agreement Shares. |

A:

| If your shares are registered directly in your name with our transfer agent, AST, you are considered a stockholder of record with respect to those shares. If you are a record holder, the Notice is being sent to you directly by Broadridge Investor Communication Solutions, Inc. (“Broadridge”). Please carefully consider the information contained in this Proxy Statement and, whether or not you plan to attend the Annual Meeting, please vote by (i) accessing the Internet website specified on the Notice, (ii) calling the toll-free number specified on your proxy card, if you requested printed copies of the proxy materials or (iii) marking, signing and returning your proxy card promptly, if you requested printed copies of the proxy materials, so that we can be assured of having a quorum present at the Annual Meeting and so that your shares may be voted in accordance with your wishes, even if you later decide to attend the Annual Meeting. |

If you hold shares in the name of a broker, bank or other nominee you may be able to vote those shares by Internet or telephone depending on the voting procedures used by your broker, bank or other nominee, as explained below under the question “How do I vote if my shares are held in “street name” by a broker, bank or other nominee?”

Q:

| How do I vote if my shares are held in “street name” by a broker, bank or other nominee? |

A:

| If your shares are held by a broker, bank or other nominee (this is called “street name”), your broker, bank or other nominee will send you instructions for voting those shares. Many (but not all) brokerage firms, banks and other nominees participate in a program provided through Broadridge that offers Internet and telephone voting options. |

Q:

| If I vote by proxy, can I still access the Annual Meeting and vote there if I choose? |

A:

| Yes. If you are a stockholder of record, the method you use to vote will not limit your right to vote at the virtual Annual Meeting if you decide to participate. As indicated, we are hosting the Annual Meeting exclusively online at www.virtualshareholdermeeting.com/HUBG2023. There will be no physical location at which stockholders may attend the Annual Meeting, but stockholders may attend and participate in the meeting electronically. Stockholders who participate in the virtual Annual Meeting will be deemed to be present in person and will be able to vote during the Annual Meeting at the times that the polls are open. Stockholders who wish to attend the meeting should go to www.virtualshareholdermeeting.com/HUBG2023 at least 10 minutes before the beginning of the meeting to register their attendance and complete the verification procedures to confirm that they were stockholders of record as of March 29, 2023. The Notice |

TABLE OF CONTENTS

includes instructions on how the shares of Class B Common Stock will be voted on matters presented atto participate in the Annual Meeting. Under the Stockholders’ Agreement, if there is a deadlock among Class B Stockholders or if a quorum of Class B Stockholders cannot be achieved at the meeting of Class B Stockholders after two attempts, each Class B Stockholder has agreedMeeting and how to vote your shares by accessing the virtual Annual Meeting via the Internet. You will need to enter the 16-digit control number received with your proxy card or causeNotice to be voted all of its shares of Class Benter the Annual Meeting via the online web portal.

Q:

| If my shares are held in “street name” by a broker, bank or other nominee, may I still access the Annual Meeting? |

A:

| Yes. Beneficial owners whose stock is held for them in street name by their brokers or other nominees may also attend the meeting by going to www.virtualshareholdermeeting.com/HUBG2023 at least 10 minutes before the beginning of the meeting to register their attendance and complete the verification procedures to confirm that they were stockholders as of the record date. |

A:

| Yes. You will be able to submit questions live during the meeting by accessing the meeting at www.virtualshareholdermeeting.com/HUBG2023, typing your question into the “Ask a Question” field, and clicking “Submit.” Only questions pertinent to meeting matters will be answered during the meeting. |

Q:

| Is cumulative voting allowed? Do I have dissenters’ or appraisal rights? |

A:

| No. Cumulative voting rights are not authorized, and dissenters’ rights and rights of appraisal are not applicable to the matters being voted upon at the Annual Meeting. |

Q:

| What are “broker votes” and “broker non-votes”? |

A:

| On certain “routine” matters, brokerage firms have discretionary authority under applicable stock exchange rules to vote their customers’ shares if their customers do not provide voting instructions. When a brokerage firm votes its customers’ shares on a routine matter without receiving voting instructions (referred to as a “broker vote”), these shares are counted both for establishing a quorum to conduct business at the Annual Meeting and in determining the number of shares voted “FOR” or “AGAINST” the “routine” matter. For purposes of the Annual Meeting, Proposal 4 – the ratification of the appointment of E&Y as our independent registered public accountants for 2023 is considered a “routine” matter. |

Under applicable stock as recommended by the independent directors of the Board of Directors. On March 17, 2017, the independent directors resolved that in the event of a deadlock or if a quorum cannot be achieved at the meeting of Class B Stockholders after two attempts, the independent directors unanimously recommend that the Class B Stockholders vote FORexchange rules, Proposal 1 – the election of each nominee for director named in Proposal 1, FOR the approval of the Company’s executive compensation indirectors, Proposal 2 ONE YEAR for– the advisory (non-binding) vote on the compensation of our Named Executive Officers (“say-on-pay” vote), Proposal 3 – the advisory (non-binding) vote on the frequency of the advisory vote on executiveregarding the compensation inof our Named Executive Officers (“say-on-frequency” vote), and Proposal 3, FOR the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm in Proposal 4 and FOR5 – the approval of the Company’s 2017 Long-Term Incentive Plan inCharter Amendment are considered “non-routine” matters for which brokerage firms do not have discretionary authority to vote their customers’ shares if their customers did not provide voting instructions. Therefore, for purposes of the Annual Meeting, if you hold your stock through a brokerage account, your brokerage firm may not vote your shares on your behalf on Proposal 1, 2, 3 or 5 without receiving instructions from you. When a brokerage firm does not have the authority to vote its customers’ shares or does not exercise its authority, these situations are referred to as “broker non-votes.” Broker non-votes are only counted for establishing a quorum and will have no effect on the outcome of the vote on Proposals 1, 2 and 3. Broker non-votes will have the same effect as a vote against Proposal 5.

We encourage you to provide instructions to your brokerage firm, bank or other nominee by voting your proxy. This action ensures your shares will be voted at the Annual Meeting on all matters up for consideration.

Q:

| What if I abstain from voting? |

A:

| You have the option to “ABSTAIN” from voting with respect to Proposal 2 – the advisory (non-binding) vote on the compensation paid to our Named Executive Officers (“say-on-pay”), Proposal 3 – the advisory (non-binding) vote on the frequency of advisory votes regarding the compensation paid to our Named Executive Officers (“say-on-frequency”), Proposal 4 – the ratification of the appointment of E&Y as the Company’s independent registered public accountants for 2022 and Proposal 5 – the approval of the Charter Amendment. Abstentions with respect to these proposals are counted for purposes of establishing a quorum. If a quorum is present, abstentions will have the same effect as a vote against these proposals. |

TABLE OF CONTENTS

Q:

| May I revoke my proxy after I have delivered my proxy? |

A:

| Yes. You may revoke your proxy at any time before the polls close by submitting a subsequent proxy with a later date by using the Internet, by telephone or by mail or by sending our Corporate Secretary a written revocation. Your proxy also will be considered revoked if you attend the Annual Meeting and vote via the virtual portal. If your shares are held in “street name” by a broker, bank or other nominee, you must contact your broker, bank or other nominee to change your vote or obtain a proxy to vote your shares if you wish to cast your vote during the virtual Annual Meeting. |

Q:

| How will my shares be voted if I return my proxy card or vote via telephone or Internet? What if I return my proxy card but do not provide voting instructions or complete the telephone or Internet voting procedures but do not specify how I want to vote my shares? |

A:

| Our Board of Directors has named Phillip D. Yeager, our President and Chief Executive Officer, Brian Alexander, our Executive Vice President and Chief Operating Officer, and Thomas P. LaFrance, our Executive Vice President, General Counsel and Corporate Secretary, as official proxy holders. They will vote all proxies, or record an abstention or withholding, in accordance with the directions on the proxy. |

All shares represented by properly executed proxies, unless previously revoked, will be voted at the Annual Meeting as you direct.

IF YOU SIGN AND RETURN YOUR PROXY CARD BUT GIVE NO DIRECTION OR COMPLETE THE TELEPHONE OR INTERNET VOTING PROCEDURES BUT DO NOT SPECIFY HOW YOU WANT TO VOTE YOUR SHARES, THE SHARES WILL BE VOTED “FOR ALL” OF THE PERSONS NAMED HEREIN AS DIRECTORS; “FOR” THE PROPOSAL REGARDING AN ADVISORY (NON-BINDING) VOTE ON THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS (“SAY-ON-PAY”); FOR A FREQUENCY OF “ONE YEAR” FOR THE PROPOSAL REGARDING THE FREQUENCY OF AN ADVISORY (NON-BINDING) VOTE ON THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS (“SAY-ON-FREQUENCY”); “FOR” THE RATIFICATION OF THE APPOINTMENT OF E&Y AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR 2023; AND “FOR” THE PROPOSAL APPROVING THE CHARTER AMENDMENT.

Q:

| Who will count the votes? |

A:

| A representative of Broadridge has been appointed as an inspector of elections for the Annual Meeting. That person will tabulate votes cast by proxy or during the Annual Meeting as well as determine whether a quorum is present. |

Q:

| Where can I find voting results of the Annual Meeting? |

A:

| We will announce preliminary voting results at the Annual Meeting and publish final results on a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting (a copy of which will be available on the “Investors” section of our website, www.hubgroup.com, under the link “SEC Filings”). If our final voting results are not available within four business days after the Annual Meeting, we will file a Current Report on Form 8-K reporting the preliminary voting results and subsequently file the final voting results in an amendment to the Current Report on Form 8-K within four business days after the final voting results are known to us. |

Q:

| May I propose actions for consideration at the next Annual Meeting of Stockholders or nominate individuals to serve as directors? |

A:

| You may submit proposals for consideration at future stockholder meetings, including director nominations. Please see “PROPOSAL 1: ELECTION OF DIRECTORS – Can stockholders recommend or nominate directors?” and “STOCKHOLDER PROPOSALS FOR 2024 ANNUAL MEETING” for more details. |

The Board of Directors knows of no matters to be presented at the Annual Meeting other than those set forth in the Notice of 20172023 Annual Meeting of Stockholders enclosed herewith. However, if any other matters do come before the meeting,Annual Meeting, it is intended that the holders of the proxies will vote thereon in their discretion. Any such other matter will require for its approval the affirmative vote of a majority of votes votes.

TABLE OF CONTENTS

cast by shares represented in person or by proxy and entitled to vote at such Annual Meeting, provided a quorum is present, or such greater vote as may be required under the Company’s Amended and Restated Certificate of Incorporation, the Company’s Bylaws or applicable law. A list

Q:

| Whom should I contact with questions about the Annual Meeting? |

A:

| If you have any questions about this Proxy Statement or the Annual Meeting, please contact Thomas P. LaFrance, our Executive Vice President, General Counsel and Corporate Secretary, at 2001 Hub Group Way, Oak Brook, Illinois 60523 or by telephone at (630) 271-3600. |

Q:

| What information is available on the Internet? |

A:

| A copy of this Notice of Annual Meeting, our Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2022 and the proxy card or voting instructions are available for download free of charge at www.proxyvote.com. |

Additionally, our website address is www.hubgroup.com, which is used to distribute important Company information. At the “Investors” tab of stockholdersour website (under the link “SEC Filings”), we make available, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, ownership reports on Forms 3, 4 and 5 and any amendments to those reports as soon as practicable after they are electronically filed with the SEC.

Information from our website is not incorporated by reference into this Proxy Statement.

Special Note Regarding Forward-Looking Statements

Statements in this proxy statement that are not historical may express or imply projections of revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. Forward-looking statements are inherently uncertain and subject to risks, uncertainties and other factors that might cause the actual performance of Hub Group, Inc. to differ materially from those expressed or implied by this discussion and, therefore, should be viewed with caution. All forward-looking statements and information are provided pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995 and should be evaluated in the context of these factors. Forward-looking statements generally may be identified by the use of forward-looking terminology such as “trends”, “assumptions”, “target”, “guidance”, “outlook”, “opportunity”, “future”, “plans”, “goals”, “objectives”, “expects”, “expected”, “anticipates”, “may”, “will”, “would”, “could”, “intend”, “believe”, “potential”, “projected”, “estimate” (or the negative or derivative of each of these terms), or similar words, and include our statements regarding our outlook, profit improvement initiatives and capital expenditures. These statements are based on Hub Group’s current beliefs and expectations of future events or future results, and involve risks and uncertainties that are difficult to predict and subject to change. Factors that could cause actual results to differ materially include, among other things; general or regional economic conditions, including inflation and changes in trade policy, the effect of the record date will be available for inspection atongoing COVID-19 pandemic (including any spikes, outbreaks or variants of the Annual Meetingvirus) and for a period of ten days priorany future government actions taken in response to the pandemic on our business operations and general economic and financial market conditions; governmental or regulatory requirements affecting tax, wage and hour matters, health and safety, labor and employment, insurance or other areas; shipping and intermodal costs and prices, the integration of acquisitions and expenses relating thereto; driver shortages; the amount and timing of strategic investments or divestitures by Hub Group; the failure to implement and integrate critical information technology systems; cyber security incidents; and retail and other customers encountering adverse economic conditions. Except as required by law, we expressly disclaim any obligations to publicly update any forward-looking statements whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements, in addition to those described in detail under Item 1A “Risk Factors,” of our most recent Annual Meeting atReport on Form 10-K filed with the Company’s offices in Oak Brook, Illinois.Securities and Exchange Commission (SEC) and our other filings with the SEC.

TABLE OF CONTENTS

PROPOSAL 1:

ELECTIONELECTION OF DIRECTORSThe number of directors

What is the structure of the Company, as determinedBoard of Directors?

Our Amended and Restated Certificate of Incorporation requires that our Board of Directors consist of 3 to 12 members, with the actual number set by the Board. The Board size is currently ten. Directors are elected by our stockholders on an annual basis.

How are directors identified and nominated?

Directors may be nominated by the Board of Directors or by stockholders as described below under Article III“Can stockholders recommend or nominate directors?” The Nominating and Governance Committee is responsible for identifying, evaluating and recommending qualified director candidates, including the director slate to be presented to stockholders at the Annual Meeting, to our Board, which makes the ultimate election or nomination determination, as applicable. The Nominating and Governance Committee may use a variety of methods to identify potential director candidates, such as recommendations by our directors, management, stockholders or third-party search firms. Neither the Company nor the Nominating and Governance Committee currently utilizes the services of any search firm to identify or assist in identifying or evaluating potential nominees.

Does the Board consider diversity when identifying director nominees?

Yes. The Nominating and Governance Committee seeks to identify candidates who will provide a diversity of viewpoints, professional experience, education and skills that complement those already existing on the Board. In addition, in selecting directors, the Nominating and Governance Committee will consider the need to strengthen the Board by providing a diversity of persons in terms of their expertise, age, gender, race, ethnicity, education, and other attributes that contribute to the Board’s diversity. In performing its responsibilities for identifying, screening and recommending candidates to the Board, the Nominating and Governance Committee (i) ensures that candidates with a diversity of backgrounds are included in any pool of candidates from which Board nominees are chosen and (ii) considers diverse candidates from nonexecutive corporate positions and non-traditional environments.

What are the backgrounds of the nominees?

As required by the NASDAQ listing standards, set forth below is information regarding our nominees’ self-identified gender and demographic backgrounds:

| | Board Diversity Matrix (As of April 4, 2023) | |

| | Total Number of Directors (including nominees) | | | 10 | |

| | | | | Female | | | Male | |

| | Part I: Gender Identity | |

| | Directors | | | 3 | | | 7 | |

| | Part II: Demographic Background | |

| | African American or Black | | | 1 | | | | |

| | White | | | 2 | | | 7 | |

How are nominees evaluated; what are the threshold qualifications?

The Nominating and Governance Committee is charged with recommending to our Board only those candidates that it believes are qualified to serve as Board members consistent with the criteria for selection of new directors adopted from time to time by the Board.

In determining a candidate’s suitability for consideration for membership on the Board, the Nominating and Governance Committee reviews all proposed nominees for the Board, including those proposed by stockholders, in accordance with the mandate contained in its charter. The Nominating and Governance Committee assesses a candidate’s independence, background, and experience, as well as our current Board’s skill needs. With respect to incumbent directors considered for re-election, the Nominating and Governance Committee also assesses each

TABLE OF CONTENTS

director’s meeting attendance record and suitability for continued service. In addition, the Nominating and Governance Committee determines whether nominees are in a position to devote an adequate amount of time to the effective performance of director duties and possess the following threshold characteristics: informed judgment, integrity and accountability, record of achievement, understanding of the Company’s Bylaws, is currently seven. Thebusiness or other related industries, a cooperative approach, loyalty, the ability to consult with and advise management, and such other factors as the Nominating and Governance Committee determines are relevant considering the needs of the Board of Directors has decidedand the Company. The Nominating and Governance Committee recommends candidates, including those submitted by stockholders, only if it believes a candidate’s knowledge, experience, and expertise would strengthen the Board and that the candidate is committed to expandrepresenting the numberlong-term interests of all Hub Group stockholders.

Who are the nominees this year?

All nominees for election as directors at the Annual Meeting were nominated by the Board of Directors for election by stockholders at the Annual Meeting upon the recommendation of the Nominating and Governance Committee. Our nominees consist of the seven incumbent directors who were elected at the 2022 annual meeting of stockholders and each of Gary Yablon and Lisa Dykstra, who were appointed by the Board to eight,join effective uponMay 24, 2022, and Phillip D. Yeager, who was appointed by the Board of Directors to join effective January 1, 2023. Our Board believes that each of the eight nominees receiving a pluralitycan devote an adequate amount of votes cast attime to the 2017 Annual Meeting. Eacheffective performance of director shallduties and possesses all of the threshold qualifications identified above.

If elected, each nominee would hold office until

the 2024 Annual Meeting or until his

or her successor is elected and qualified or until his

or her earlier death, resignation, retirement, disqualification or removal.

The

following lists the nominees,

for whomtheir ages at the

encloseddate of this proxy

is intended to be voted are set forth below. Mr. Yeager, Mr. Maltby, Mr. Eppen, Mr. Kenny, Mr. Reaves, Mr. Slarkstatement, and

Mr. Ward each currently serves asthe calendar year in which they first became a director,

of the Company. Mr. Peter B. McNitt is being nominated by the Board for the first time. The descriptions below discussalong with their biographies and the specific experience, qualifications, attributes or skills that

qualifyled the Board to conclude that each nominee

toshould serve

on the Company’sas a member of our Board of Directors.

It is not contemplated that any of these nominees will be unavailable for election, but if such a situation should arise, the proxy will be voted in accordance with the best judgment of the proxyholder for such person or persons as may be designated by the Board of Directors unless the stockholder has directed otherwise.Directors are elected by a plurality of the votes cast by the shares represented in person or by proxy and entitled to vote on the election of directors at the Annual Meeting, provided a quorum is present. Withholding of authority to vote in the election and broker non-votes will not affect the outcome of the election, provided a quorum is present. Stockholders are not allowed to cumulate their votes in the election of directors.

Nominees for Election as Directors

David P. Yeager

Committees:

None | | 64 | 70 | | | David P. Yeager haswas appointed Executive Chairman of the Board effective January 1, 2023. Mr. Yeager served as the Company’s Chairman of the Board since November 2008 and served as Chief Executive Officer of the Company sincefrom March 1995.1995 until December 31, 2022. Mr. Yeager was Vice Chairman of the Board from March 1995 through November 2008. From October 1985 through December 1991, Mr. Yeager was President of our predecessor, Hub Chicago. From 1983 to October 1985, he served as Vice President, Marketing of Hub Chicago. Mr. Yeager started working for the Company in 1975. Mr. Yeager received a Masters in Business Administration degree from the University of Chicago in 1987 and a Bachelor of Arts degree from the University of Dayton in 1975. |

| | | | |

| | | | Dayton. Mr. Yeager is the father of Mr. Phillip D. Yeager.

Mr. Yeager formerly served as the Chair of the University of Dayton Board of Trustees. He has been an employee of the Company for over 40 years and in that time has helped grow the Company from a small family business into the $3.6over $5 billion enterprise it is today. Mr. Yeager has experience in all aspects of the business, including acting as founder and President of both the Pittsburgh Hub (1975) and the St. Louis Hub (1980). Mr. Yeager’s industry experience and Company knowledge make him uniquely suited to serve as our Chairman of the Board. |

| | | | | | |

Donald G. MaltbyPhillip D. Yeager

Committees:

None | | 62 | 36 | Donald G. Maltby | | Phillip D. Yeager was appointed a director effective January 1, 2023 in connection with his assumption of the role of President and Chief Executive Officer on January 1, 2023. Prior to this appointment, Mr. Yeager served as President and Chief Operating Officer since July 2019, and as Chief Commercial Officer overseeing Intermodal and |

TABLE OF CONTENTS

| | | | | | Truck Brokerage operations as well as sales, pricing, solutions and account management since January 2018. Mr. Yeager formerly held the role of Executive Vice President, Account Management and Intermodal Operations since January 2016 after serving as Vice President of Account Management and Business Development from February 2014 to January 2016. Mr. Yeager joined the Company in 2011 as the Director of Strategy and Acquisitions. Prior to joining the Company, Mr. Yeager served as Assistant Vice President of Commercial Banking at BMO Harris Bank, and as an investment banking analyst for Lazard Freres & Co. Mr. Yeager earned his Bachelor of Arts degree from Trinity College and a Master of Business Administration degree from the University of Chicago Booth School of Business. Mr. Yeager is the son of David P. Yeager.

Mr. Phillip D. Yeager’s deep knowledge of many aspects of the Company’s operations, having served in a wide variety of roles and serving now as President and Chief Executive Officer, brings to the Board a critical operational and strategic perspective in support of its oversight obligations. |

| | | | | | |

Peter B. McNitt

Committees:

Audit (Chair)

Compensation

Nominating and

Governance | | | 68 | | | Peter B. McNitt has served as a director of the Company since 2016.May 2017 and as our Lead Independent Director since November 2019. Mr. Maltby was appointedMcNitt, currently retired, most recently served as Vice Chair of BMO Harris Bank, N.A. until December 2018. Prior to this position, Mr. McNitt held many leadership roles within BMO Harris, including Senior Vice President and Chief Operating OfficerHead of the Company in September 2015. From January 2015 until September 2015,Emerging Majors Midwest, Executive Vice President of U.S. Corporate Banking, Executive Managing Director of U.S. Investment Banking, and Vice Chair of Business Banking. Mr. Maltby servedMcNitt currently serves as an advisora director of Old Republic International Corporation (Insurance), where he is a member of the audit committee and compensation committee. He is a graduate of Amherst College and has attended Northwestern University’s Graduate School of Management and the Graduate School of Credit and Finance at Stanford University.

As a director, Mr. McNitt brings over 40 years of financial expertise assessing corporate strategies, financial performance, management succession and risk, as well a great deal of public company board experience. In addition to his role as our Lead Director, Mr. McNitt utilizes his financial expertise as Chair of our Audit Committee to help oversee and provide guidance on the Company’s Board of Directors. Mr. Maltby served as Chief Strategy Officer from May 2014 until January 2015. Prior to that, Mr. Maltby served as Chief Supply Chain Officer from January 2011 to May 2014. From February 2004 to December 2010, Mr. Maltby served as Executive Vice President- Logistics Services. Mr. Maltby previously served as President of Hub Online, the Company’s e-commerce division, from February 2000 through January 2004. Mr. Maltby also served as President of Hub Cleveland from July 1990 through January 2000internal controls and from April 2002 to January 2004. Prior to joining Hub Group, Mr. Maltby served as President of Lyons Transportation, a wholly owned subsidiary of Sherwin Williams Company, from 1988 to 1990. In his career at Sherwin Williams, which began in 1981 and continued until he joined the Company in 1990, Mr. Maltby held a variety of management positions including Vice-President of Marketing and Sales for its Transportation Division. Mr. Maltby received a Masters in Business Administration from Baldwin Wallace College in 1982 and a Bachelor of Science degree from the State University of New York in 1976.financial practices. |

| | | | | | |

Mary H. Boosalis

Committees:

Audit

Compensation

Nominating and

Governance (Chair) | | | 68 | Mr. Maltby has been in the transportation and logistics industry since 1976, holding various executive and management positions. He has steadily assumed additional responsibility and has been instrumental in growing the Company’s logistics business since joining the Company over 25 years ago. Mr. Maltby’s strategic thinking and deep knowledge of the logistics industry, as well as familiarity with the Company’s business and culture, make him a valuable contributor to the Board. |

Name | | Age | | Business Experience During the Past Five Years

and Other Information

|

Gary D. Eppen

| | 80

| | Gary D. Eppen

Mary H. Boosalis has served as a director of the Company since February 1996. Currently retired, Mr. EppenMay 2018. From 2017 to 2022, she served as President and CEO of Premier Health, the largest health system in southwest Ohio. Ms. Boosalis served as President of Premier Health and as Executive Vice President and Chief Operating Officer for the organization from 2013 to 2017. Ms. Boosalis joined the health system in 1986, progressively expanding her leadership roles, including five years as President and CEO of Miami Valley Hospital.

|

TABLE OF CONTENTS

| | | | | | Ms. Boosalis is a past diplomat of the American College of Healthcare Executives, a member of the Ohio Hospital Association Board and a member of the Greater Dayton Area Hospital Association Boards. She is the immediate past Chair of the University of Dayton Board of Trustees. Additionally, she has been a member of the Dayton Chamber of Commerce Board, the Dayton Business Committee, the Dayton Development Committee, the Dayton Minority Inclusion Committee and the Learn to Earn Board. Ms. Boosalis has been named to the Top 10 Women list by the Dayton Daily News, as an Ohio Most Powerful and Influential Woman by the Ohio Diversity Council, and as a Woman of Influence by the Dayton YWCA. In 2022, Ms. Boosalis was recognized as the RalphDayton Business Person of the Year. Ms. Boosalis earned a Bachelor’s degree in Nursing, magna cum laude, from California State University at Fresno and Dorothy Keller Distinguished Service Professora Master’s degree in Health Services Administration, magna cum laude, from Arizona State University.

In her capacity as Chief Executive Officer of Operations ManagementPremier Health, Ms. Boosalis has gained valuable executive experience in all aspects of business. Having served on numerous civic committees and Deputy Deanboards, Ms. Boosalis is able to advise best practices across different industries. |

| | | | | | |

| | | | | | |

Lisa Dykstra

Committees:

Audit

Compensation

Nominating and

Governance | | | 52 | | | Lisa Dykstra has served as a director of Hub Group since May 2022. Ms. Dykstra serves as the Senior Vice President and Chief Information Officer for part-time programsAnn & Robert H. Lurie Children’s Hospital, a position she has held since 2015. She has spent much of her nearly thirty-year information technology career in leadership positions at Thethe country’s top academic medical centers including the University of Chicago Booth SchoolMedicine, Rush University Medical Center, and Northwestern Memorial Hospital. Ms. Dykstra’s career focus is to drive healthcare delivery transformation and value, including through applications, digital health, information and cyber security, and technology programs. She is an award-winning CIO, being named Enterprise CIO of Business. Hethe Year 2019 and winning a Chicago Orbie award. She is actively involved on several community and industry boards, including Erie Family Health, the InspireCIO/Chicago CIO Leadership Association and the College of Healthcare Information Management Executives. Ms. Dykstra has served on the American Heart Association — Go Red For Women Board since 2016. She received a Ph.D. in Operations Research from Cornell University in 1964, a Master of Science in Industrial Engineering from the University of Minnesota in 1960, a Bachelor of ScienceArts in Communications from DePaul University.

Ms. Dykstra’s experience leading technology and information systems at some of the University of Minnesotacountry’s leading hospital adds to the Board substantial expertise and knowledge in 1959information technology, privacy, data governance and an Associate in Arts degree in Pre-Engineering from Austin Junior College in 1956. He received an Honorary Doctor of Economics degree fromcybersecurity, which are critical to the Stockholm School of Economics in 1998.Company’s competitive advantage, growth initiatives, and risk management. |

| | | | | | |

Michael E.

Flannery

Committees:

Audit

| | | 63 | Mr. Eppen’s experience with operations management has been valuable as the Company has evolved from a collection of small businesses to a unified network with a significant fleet of containers and a large drayage network. Mr. Eppen’s attention to detail and familiarity with financial matters make him an effective Chair of our Audit Committee. Until February 2007, Mr. Eppen served as a Director of Landauer, Inc. Mr. Eppen has used his vast experience to help the Board identify and implement best practices. Mr. Eppen brings a wealth of both academic and business experience to his service as a Director. |

| | | | | |

Charles R. Reaves | | 78 | | Charles R. ReavesMichael E. Flannery has served as a director of the Company since February 1996. Since 1994,April 2022. Mr. Reaves has been President and Chief Executive Officer of Reaves Enterprises, Inc., a real estate development company. From April 1962 until November 1994, Mr. Reaves worked for Sears Roebuck & Company in various positions, ultimately as President and Chief Executive Officer of Sears Logistics Services, Inc., a transportation, distribution and home delivery subsidiary of Sears Roebuck & Company. Mr. Reaves received a Bachelor of Science degree in Business Administration from Arkansas State University in 1961. |

| | | | |

| | | | Having served for 32 years as an executive at Sears, Mr. Reaves understands the needs of large shippers and retailers. In his capacity as Chief Executive Officer of Sears Logistics Services, Inc., Mr. Reaves gained valuable executive experience running a large transportation organization. Mr. Reaves has used this experience, as well as his industry knowledge, to effectively advise the Company in his role as a Director. As Chair of our Nominating and Governance Committee, Mr. Reaves has also used his experience at Sears to help shape the Company’s Governance Policies and oversee the succession planning process. |

| | | | |

Martin P. Slark | | 62 | | Martin P. Slark has served as a director of the Company since February 1996 and Lead Director since November 2016. Since 1976, Mr. Slark has been employed by Molex Incorporated (“Molex”), a manufacturer of electronic, electrical and fiber optic interconnection products and systems. Mr. SlarkFlannery is presently the Chief Executive Officer of Molex and is also a Director of Liberty Mutual Holding Company, Inc., Northern Trust Corporation and Koch Industries. Mr. Slark is a Companion of the British Institute ofDuchossois Capital Management and received a Masters in Business Administration degree from the University of East London in 1993 and a Post-Graduate Diploma in Management Studies from Portsmouth University in 1981. |

| | | | |

| | | | As Chief Executive Officer of a multi-national company, Mr. Slark has extensive experience running a large organization. Mr. Slark, originally from England, has worked for Molex for over 40 years in Europe, Asia and the United States. Mr. Slark’s leadership skills, experience with strategic planning and contacts have been a significant benefit to the Board. In addition to his role as Lead Director, Mr. Slark is Chair of the Compensation Committee,(“DCM”), where he leads the firm and oversees its execution of its various investment strategies, a position he has been instrumental in helping formulate the compensation package for the Company’s executives. |

| | | | |

Jonathan P. Ward | | 62 | | Jonathan P. Ward has served as a director of the Companyheld since January 2012.May 2017. Mr. Ward is an operating partner at Kohlberg & Co. and has been with that company since July 2009. HeFlannery was previously chairman of the Chicago office of Lazard Ltd. and managing director, Lazard Freres & Co., LLC, joining Lazard in November 2006. Prior to Lazard, Mr. Ward was at The ServiceMaster Company for five years, where he began asappointed President and Chief Executive Officer in 2001 and then became Chairman and Chief Executive Officer in 2002. From 1997 to 2001, he was President and Chief Operating Officer of R.R. Donnelley & Sons Company, a commercial printing company. During his 23 years at R.R. Donnelley, he served in a variety of other leadership positions. He earned a Bachelor’s degree in Chemical Engineering from the University of New Hampshire and also has completed the Harvard Business School Advanced Management Program.Managing |

TABLE OF CONTENTS

Compensation

Nominating and

Governance | | | | | | Director of DCM at the time of its creation in November 2013. Mr. WardFlannery also served for fifteen years as the Chief Financial Officer of The Duchossois Group, the parent of DCM.

Earlier in his career, Mr. Flannery served as the Chief Executive Officer of Trinity Rail Group, LLC, a leading designer and manufacturer of rail cars for the North American and European markets, as Vice Chairman of Thrall Car, a predecessor company to Trinity Rail, and as Chief Administrative Officer of The Duchossois Group. Mr. Flannery began his career as a lawyer with the Chicago firm of Burke, Griffin, Chomicz and Wienke and served as Corporate Counsel for Cummins Inc. Mr. Flannery received his Bachelor of Science degree in Finance from the University of Illinois in Champaign, Illinois and his J.D. cum laude from Indiana University Maurer School of Law in Bloomington, Indiana.

Mr. Flannery is a member of the boardBoard of directorsDirectors of SP Plus Corporation, where he serves asThe Chamberlain Group, Inc., Maritz, Inc., Energy Distribution Partners, Riverside Rail, the Board of Trustees at the Field Museum, the Board of Visitors for the Indiana University Maurer School of Law, and the Board of Directors of the Executives’ Club of Chicago. He is also a member of the Compensation Committee. Young Presidents’ Organization, the Economic Club of Chicago, and the Commercial Club of Chicago.

Mr. Ward previously served as a director of Hillshire Brands Company (and Sara Lee Corporation prior to their merger) from October 2005 to August 2014, as director of KAR Auction Services, Inc. from December 2009 to June 2014,Flannery’s extensive experience in executive roles across multiple sectors (including rail), his financial acumen, and as a director of United Stationers Inc. from July 2011 to June 2012. |

| | | | |

| | | | Mr. Ward’s service as an executive, combinedexperience with his leadership capabilities,mergers and acquisitions make him well qualified to be a member of the Company’s Board of Directors. Having servedBased on numerous public company boards,his understanding of corporate investments, strategic planning, and operations, Mr. WardFlannery is well positioned to be able to advise asprovide valuable insights to best practices across multiple industries. In addition, as a member of the Compensation Committee of SP Plus Corporation, Mr. Ward brings unique insight into other compensation models and approaches. Mr. Ward’s experience and perspective make him a valuable member of the Company’s Board of Directors.Company. |

| | | | | | |

Committees:

Audit

Compensation

(Chair)

Nominating and

Governance | | 63 | 69 | | | James C. Kenny has served as a director of the Company since May 2016. Currently retired, Mr. Kenny has served on the boardas a director of Kenny Industries, LLC, since 2006. Kenny Industries is a holding company that owns office and industrial parks in northern Illinois and a luggage company, among other assets. SinceFrom 2011 until April 2020, Mr. Kenny has also served as a director of Kerry Group, PLC, a public company traded on the London and Dublin stock exchanges with a market capitalization of 13 billion euro.exchanges. Mr. Kenny servesserved as a member of Kerry Group’s Nominatingnominating and Compensation Committees. |

| | | | |

| | | | compensation committees and was Chair of the committee to select a new chairman of the Kerry Group during his time as a director.

Mr. Kenny served as Executive Vice President and Director of Kenny Construction Company from 1994 until the company was sold in 2012. He also served as President of Kenny Management Services from 2006 to 2012. Kenny Construction Company, founded in 1927, was involved in building projects across the United States and Kenny Management Services oversaw large, complex construction projects such as the Chicago Midway Airport expansion and the Chicago Bears’ stadium renovation. From 2003 until 2006, Mr. Kenny served as United States Ambassador to Ireland. Mr. Kenny received his Bachelor of Science degree in Business Administration from Bradley University. |

| | | | |

| | | |

Mr. Kenny has 35 yearsmore than three decades of business experience, in the construction industry, as well as three years of diplomatic experience serving as an ambassador. He |

TABLE OF CONTENTS

| | | | | | has extensive experience running a family business and serving on its board. As a director, he has been involved in acquisition strategy, succession planning, unionlabor relations and governance. He also has excellent political knowledge of politics and a large network, both locally and nationally, which is a great asset for a company in a regulated industry.nationally. Mr. Kenny brings a unique blend of experiences to the Board of Directors.Board. |

| | | | | | |

Peter B. McNittJenell R. Ross

Committees:

Audit

Compensation

Nominating and

Governance | | 62 | 53 | Peter B. McNitt | | Jenell R. Ross is being nominated to the Board forPresident of the Bob Ross Auto Group in Centerville, Ohio, a position she has held since 1997. Today, the dealership includes three franchises – Buick, GMC and Mercedes-Benz. The company’s Mercedes-Benz dealership was the first time. Mr. McNittAfrican-American owned Mercedes-Benz dealership in the world. Ms. Ross is the sole second-generation African-American female automobile dealer in the country. Under her leadership, the Bob Ross franchises have continued to rank as leaders in Buick, GMC and Mercedes-Benz sales and customer service.

Ms. Ross is an active member of her community, having served on the boards of numerous foundations and community service organizations. She currently serves as Vice Chair of BMO Harris Bank. Prior to his current position, Mr. McNitt held many leadership roles within BMO, including Senior Vice President and Head of the Emerging Majors Midwest, Executive Vice President of U.S. Corporate Banking, Executive Managing Director of U.S. Investment Banking, and Vice Chair of Business Banking. Mr. McNitt currently serves as a director of Titan International, Inc, where he is a member of the University of Dayton Board of Trustees and previously was the Chair of the board of directors of the Federal Reserve Board of Cleveland (Cincinnati branch). Additionally, she serves as a Board Member for the Minority Business Partnership through the Dayton Chamber of Commerce and a Board Member of the Will Allen Foundation. She has previously served on the Ohio Motor Vehicle Dealers Board and as Chair (2013) of the American International Automobile Dealers Association, a dealer-led organization representing more than 10,000 automobile dealer franchises. Ms. Ross has been recognized with numerous awards with respect to business achievements and public service. She earned a Bachelor’s degree from Emory University in Atlanta.

In her capacity as President of the Bob Ross Auto Group and her participation in other related groups, Ms. Ross has gained valuable executive and leadership experience in all aspects of business. Having served on numerous civic committees and boards, Ms. Ross is able to advise on best practices across different industries. Having served governmental agencies, she also is able to advise on interactions with regulators and governmental bodies. |

| | | | | | |

Martin P. Slark

Committees:

Audit

Compensation

Nominating and

Governance | | | 68 | | | Martin P. Slark has served as a director of the Company since February 1996 and served as our Lead Independent Director from November 2016 until November 2019. Mr. Slark was most recently employed by Molex Incorporated (“Molex”), a manufacturer of electronic, electrical and fiber optic interconnection products and systems, serving as its Chief Executive Officer from 2005 until his retirement in November 2018. Mr. Slark is a director of Liberty Mutual Holding Company, Inc., where he is chair of the risk committee and Chairmansits on the executive and investment committees. Additionally, Mr. Slark is a director of Northern Trust Corporation. Mr. Slark is a Companion of the Corporate Governance committee. He is a graduate of Amherst College and has attended Northwestern University’s Graduate SchoolBritish Institute of Management and received a Masters in Business Administration degree from the Graduate SchoolUniversity of CreditEast London and Finance at Stanforda Post-Graduate Diploma in Management Studies from Portsmouth University.

|

TABLE OF CONTENTS

| | | | |

| | | | |

As a former Chief Executive Officer of a multi-national company, Mr. McNittSlark has extensive experience running a large organization. Mr. Slark worked for Molex for over 40 years in Europe, Asia and the United States. Mr. Slark’s leadership skills, experience with strategic planning and contacts have been a significant benefit to the Board. |

| | | | | | |

Gary Yablon

Committees:

Audit

Compensation

Nominating and